Ways to Give

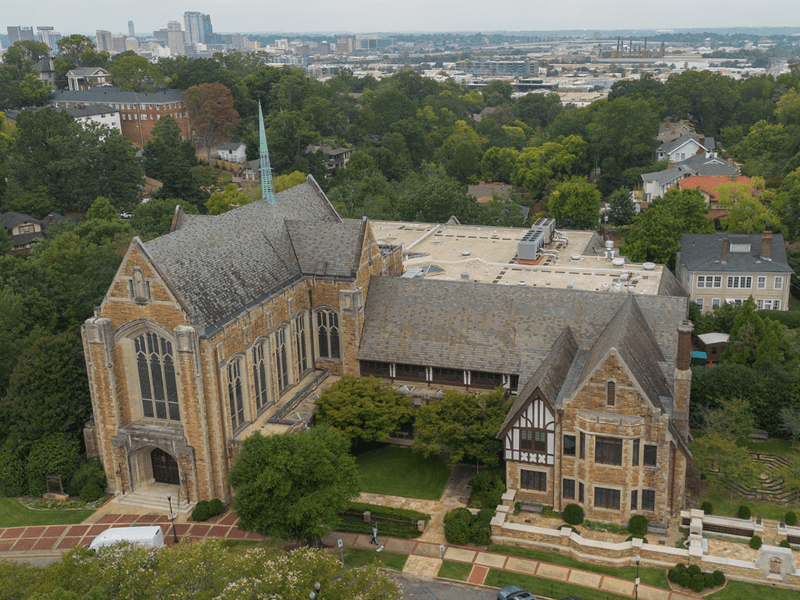

Gifts can be made to Independent Presbyterian Church or to the Independent Presbyterian Church Foundation in the following ways. Please contact Denise Moore at (205) 933-3705 or dmoore@ipc-usa.org for more information or if you have questions.

- Annual Giving allows you to pledge yearly support for Independent Presbyterian Church worship, ministries, and operations. Gifts can be made online, through mail, or by stock transfer.

- One-time Gifts and Donations to Independent Presbyterian Church or Independent Presbyterian Church Foundation enable you to invest in specific ministries, projects, education, worship, or areas of Church operation. Gifts can be made online, through mail, or by stock transfer.

- Memorials honor or celebrate someone or a special occasion. Gifts can be made online, through mail, or by stock transfer.

- Non-cash gifts, such as gifts of stock, allow you to support IPC or complete a pledge in an easy, tax-effective way.

- Deferred or estate gifts to Independent Presbyterian Church Foundation allow you to invest in IPC’s future with a gift through your will, or a beneficiary designation of your life insurance policy or retirement plan.

- Gift planning allows the creation of gifts that pay you income and benefit the church at the end of the income stream.

Current Opportunities to Give

Discover the highlights of our ministries in the 2025 Annual Report, showcasing how God has been actively working through IPC over the past year.

As the needs of the congregation and our community continue to grow, year-end gifts are a way to bless our church and allow our ministries to continue to flourish. If you plan to make a charitable contribution before the end of the year, please consider IPC.

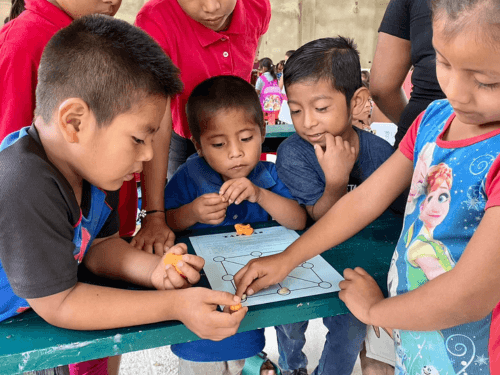

In Alabama one recent report found that 1 in 6 adults and 1 in 4 children face food insecurity. In the city of Birmingham, the poverty rate sits at approximately 24 percent—nearly double the statewide average. With the winter season, more families are turning to local ministries for help. You can help support our neighbors in need this Advent season through IPC's Giving Tree, which supports IPC Social Services and/or the Children’s Fresh Air Farm.